The GBP/USD currency pair showed no notable movements this week. Overall, expectations at the beginning of the week were high, but they did not materialize for several reasons. We have repeatedly stated that macroeconomic data are an important component for predicting movements in any currency, but they are often contradictory and ambiguous. Thus, at times, the market does not respond to these figures in a logical or predictable way. Based on the same numbers, different traders can draw different conclusions. This likely happened this week as well.

Of course, the key report of the past week was the Non-Farm Payrolls. What were the market's expectations? Following the disappointing JOLTs and ADP reports, traders anticipated 50,000 to 70,000 new jobs for January at best. This is where the contradictions begin. First of all, it should be noted that even 70,000 jobs is extremely low for the U.S. economy. A normal figure would be 150,000 to 200,000 per month, which the American labor market can only dream of right now. Thus, any figure below 150,000-200,000 per month cannot be considered positive, indicating the absence of a positive trend.

In the end, 130,000 Non-Farm jobs were created in January, which is much higher than expectations, but still not a lot. When traders saw this figure, they were swept up in euphoria for about an hour, and the dollar surged upwards; however, it was also reported that the total number of jobs in 2025 had been revised down by "only" 400,000. According to the Bureau of Statistics' reassessment, approximately 180,000 jobs were created in 2025 (130,000 in January 2026). How should January's Non-Farm Payrolls be interpreted in this case?

On one hand, it could be argued that the labor market is indeed recovering, thanks to three cuts in the Fed's key rate, and things will improve. On the other hand, what guarantees are there that the January increase is not an isolated incident? What guarantees are there that the Bureau of Statistics won't revise the current data in the following month or at the end of 2026 by tens or hundreds of thousands downward? We would say that trust in statistical information from across the ocean has significantly decreased. Unemployment and labor market data are constantly revised or contradict each other. For example, the ADP report shows only 20,000 new jobs, Non-Farms show 130,000, JOLTs vacancies drop by 0.7 million, while the unemployment rate decreases to 4.3%...

Thus, the market is currently in a state of complete confusion. Traders do not understand how to react to figures that are optimistic for January but simultaneously indicate a total failure for 2025. In such situations, it is necessary to turn to technical analysis for assistance. On the daily time frame, a clear upward trend is visible, which leaves no doubt. We expect this trend to persist and for the dollar to decline further.

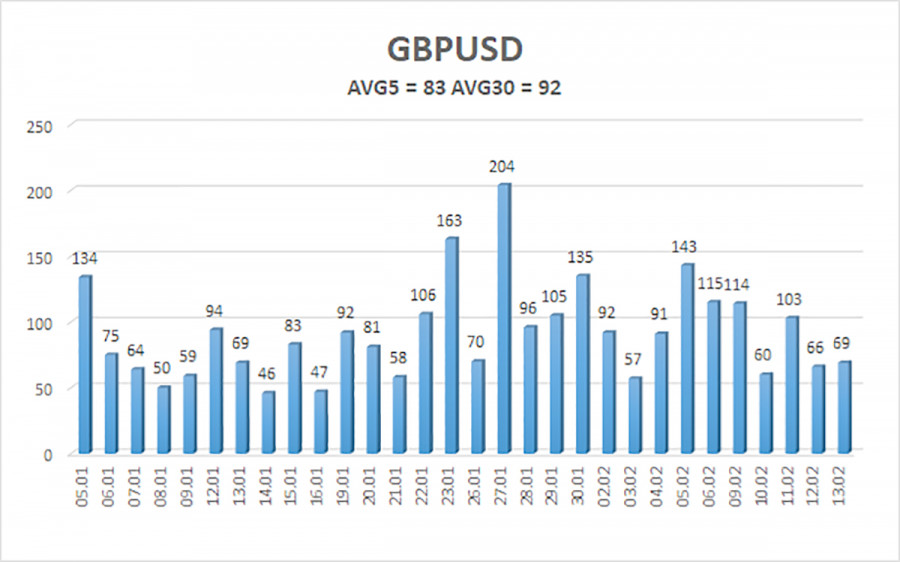

The average volatility of the GBP/USD pair over the last 5 trading days as of February 15 is 83 pips, which is "average." On Monday, February 16, we expect the pair to move within a range limited by levels 1.3570 and 1.3736. The upper channel of the linear regression is directed upwards, indicating a recovery of the trend. The CCI indicator has entered the overbought area, signaling a correction on January 26 that may already be complete.

Nearest Support Levels:

- S1 – 1.3550

- S2 – 1.3428

- S3 – 1.3306

Nearest Resistance Levels:

- R1 – 1.3672

- R2 – 1.3794

- R3 – 1.3916

Trading Recommendations:

The GBP/USD pair is set to continue its 2025 upward trend, and its long-term outlook has not changed. Donald Trump's policies will continue to exert pressure on the U.S. economy, so we do not anticipate the dollar strengthening in 2026. Even its status as a "reserve currency" no longer matters to traders. Thus, long positions with targets of 1.3916 and above remain relevant in the near future when the price is above the moving average. If the price is below the moving average line, small shorts can be considered with a target of 1.3550 on technical (correction) grounds. From time to time, the U.S. dollar shows corrections on a global scale, but for trend growth, it needs global positive factors.

Explanations for the Illustrations:

- Regression Channels help identify the current trend. If both are directed in the same direction, it indicates a strong current trend.

- Moving Average Line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted now.

- Murray Levels - target levels for movements and corrections.

- Volatility Levels (red lines) - the probable price channel in which the pair will spend the next day based on current volatility figures.

- CCI Indicator - its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.