The EUR/USD pair continues its growth process. Over the past two weeks, the euro has gained about 400–450 points, which can be considered strong growth. The only reason for the dollar's decline (because it is the dollar that is falling, while the European currency is benefiting from this) is Donald Trump's policies. From the very beginning of 2026, he began making decisions that caused strong concern among traders, especially those holding bearish positions. Events in the U.S. are developing rapidly, and each new headline is worse than the previous one—for the dollar, of course. Thus, probably no one in the market is currently wondering why the dollar has weakened so sharply. There is nothing unusual about this outcome, especially considering that throughout the entire second half of last year the continuation of the "bullish" trend was repeatedly noted. Those who shared this view can be congratulated.

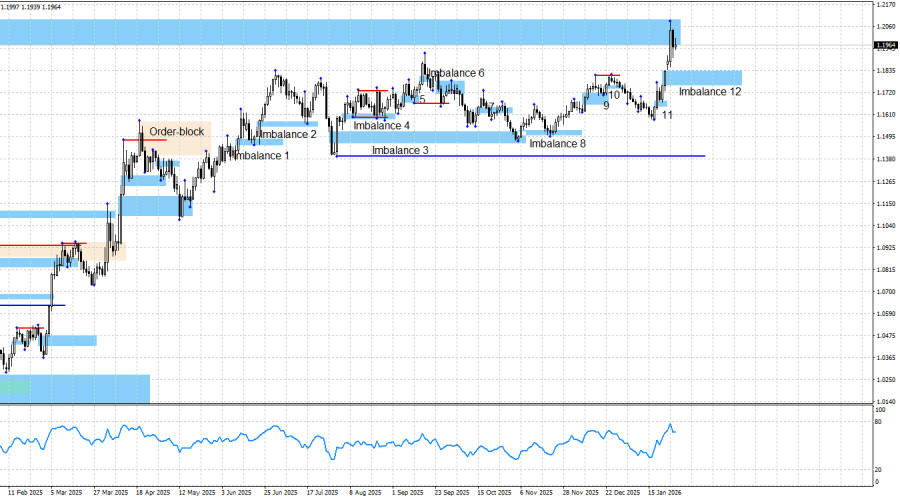

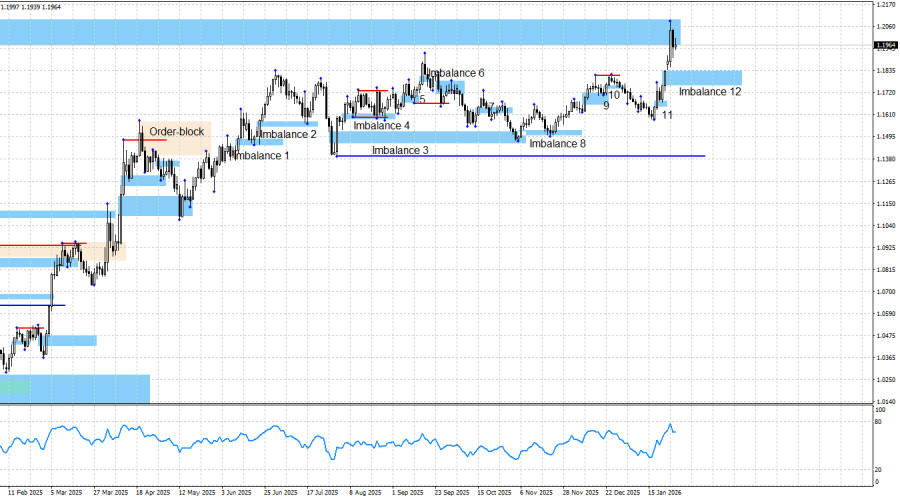

This week, a new bullish imbalance 12 was formed, and the price finally reached the target I had been writing about all last year—the weekly bearish imbalance. Thus, the ideal scenario now would be a corrective pullback toward imbalance 12 and a subsequent resumption of price growth.

The technical picture continues to signal bullish dominance. The bullish trend remains intact despite the sideways movement in the second half of last year. A new bullish signal was formed at imbalance 11, and slightly later, a new imbalance 12, within which another bullish signal may be formed in the future. However, current long positions are already showing good profits, so traders can decide for themselves how to manage them.

There was no notable news flow on Thursday, but on Wednesday evening the FOMC meeting concluded, and its results were both disappointing and unsurprising. No important decisions were made, and Jerome Powell's rhetoric was as neutral as possible. Powell did not speak about the timing of a resumption of monetary easing or about the legal investigation against himself. He only noted that inflation remains elevated, while the labor market is recovering. That is all we learned last night.

Bulls have had more than enough reasons for a new offensive for the past 6–7 months, and with each passing day, these reasons only multiply. These include the dovish (in any case) outlook for FOMC monetary policy, Donald Trump's overall policies (which have not changed recently), the confrontation between the U.S. and China (where only a temporary truce has been reached), public protests in the U.S. against Trump under the "No Kings" banner, weakness in the labor market, bleak prospects for the U.S. economy (recession), the government shutdown (which lasted a month and a half), the potential for another shutdown (which could begin as early as Sunday), and now also U.S. military aggression toward certain countries, the criminal prosecution of Powell, the "Greenland confusion," and worsening relations with Canada and South Korea. Thus, further growth of the pair, in my view, is entirely natural.

I still do not believe in a bearish trend. The news background remains extremely difficult to interpret in favor of the dollar, which is why I am not even trying to do so. The blue line shows the price level below which the bullish trend could be considered over. Bears would need to push the price down by about 570 pips to reach it, and I consider this task impossible under the current news background and circumstances.

The nearest growth target for the euro was the bearish imbalance at 1.1976–1.2092 on the weekly chart, which was formed back in June 2021. This pattern was fully filled this week. Above that, only two levels stand out—1.2348 and 1.2564. These levels represent two peaks on the monthly chart, from which liquidity could potentially be taken.

News Calendar for the U.S. and the Eurozone:

- Eurozone – Change in the unemployment rate in Germany (08:55 UTC)

- Eurozone – Change in the number of unemployed in Germany (08:55 UTC)

- Eurozone – Change in Germany's GDP in Q4 (09:00 UTC)

- Eurozone – Change in GDP in Q4 (10:00 UTC)

- Eurozone – Consumer Price Index in Germany (13:00 UTC)

- U.S. – Producer Price Index (13:30 UTC)

On January 30, the economic calendar contains six entries, about half of which can be considered interesting. The impact of the news background on market sentiment on Friday may be of moderate strength.

EUR/USD Forecast and Trader Advice:

In my view, the pair remains in the process of forming a bullish trend. Despite the fact that the news background remains on the side of the bulls, bears have launched regular attacks in recent months. Nevertheless, I see no realistic reasons for the start of a bearish trend.

From imbalances 1, 2, 4, 5, 3, 8, and 9, traders had opportunities to buy the euro. In all cases, we saw a certain rise, and the bullish trend persisted. Last week, a new bullish signal was formed from imbalance 11, which once again allowed traders to open long positions with a target of 1.1976. The target has been reached. This week, another bullish imbalance 12 was formed, which means that in the near future traders may receive a new opportunity to buy.